Executive summary:

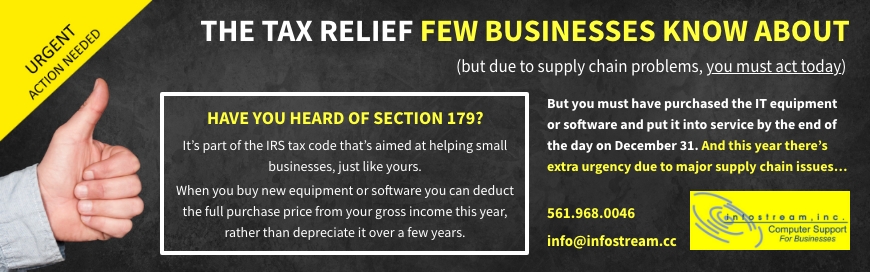

- Hidden government benefits: There’s a little known tax relief called Section 179. Where you can write off the entire spend on new IT hardware and software in this tax year (rather than depreciate over a few years)

- The clause: To qualify you must make the purchase and put it into service by the end of the day on December 31 (days away!)

- The urgency: The technology supply chain is having serious issues right now. You really should invest now in anything you think you’ll need in 2022

Have you heard of Section 179?

It’s part of the IRS tax code that’s aimed at helping small businesses, just like yours.

When you buy new equipment or software you can deduct the full purchase price from your gross income this year, rather than depreciate it over a few years.

It was designed to encourage you to invest in your business. And it’s a generous relief… you can write off up to $1,050,000 in this tax year.

There’s a comprehensive guide with illustrations, and information you can run by your CPA here.

If you want new computers, technology, or software, you need to act TODAY

The one clause is that you must have purchased the equipment or software and put it into service by the end of the day on December 31.

Not only that – the technology supply chain is having serious issues right now. It’s currently very difficult to get hold of certain specifications or pieces of equipment.

You really should invest now in anything you think you’ll need in 2022.

This is serious! It really does need urgent action if you want new technology in time to benefit from the tax relief.

I have a team on standby to help you

Unlike most IT support companies, we know all about Section 179, and how important it is to act now. We’ve been getting ready for this for months.

Here’s how to talk to us.

- Call us now on 561.968.0046 to tell us what you need

- Email: [email protected]